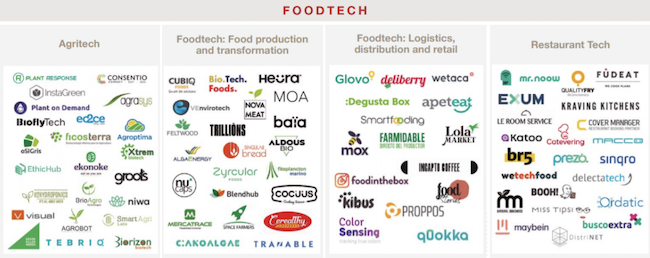

According to the report by Foods and Wines from Spain, the health of a strong innovation ecosystem is the number and quality of startups that emerge and thrive in it. In the last few years, Spain has become one of the few “foodtech” nations with more than 400 startups along the entire agri-food value chain. It stands out as a country that generates startups of high technological value, only behind the United Kingdom, Israel or the United States. However, the data is skewed by the startup ecosystem youth since more than 60% do not exceed 3 years of life and 13% of these startups have been created during the pandemic.

The key factor supporting the competitiveness of Spanish foodtech startups is their technological component and their use of what is known as “deep tech”. Additionally, 64% of the Spanish startups develop their technology “in house” and more than 60% of projects use at least one of the technologies considered as “deep”, thus positioning themselves in the “avant-garde” of the food sector.

As we can see, Spain is developing a strong foodtech startup ecosystem, soon joining the big players in the startup world.

Supply chain with a large technological component

As all the industries adapt to the new technologies and digitalization that are constantly being created, some do it faster than others. Overall, the food and agriculture industries are among the slowest to integrate digitalization when compared to other sectors of the global economy. While it is well understood that modernization and investment in data infrastructure is necessary and essential in the food industry, many times that first step and the challenge of digitizing the system is still a real hurdle. And, of course, all the players that affect the supply chain should participate in the process of digital transformation for it to be effective.

For that to be possible, it is needed to tap into machine learning and artificial intelligence for data automation, document processing and back office processes like managing vendors, suppliers, contracts, key communications, appointments, and more. Because of the highly fragmented nature and irregular ecosystems, data automation brings the necessary resource management, accuracy and most importantly, an underlying digital foundation to the food supply chain.

The players who have access to this kind of data from the retailers, consumers and foodservice outlets, can control several steps in the supply chain, and gather a better understanding of when and where to sell, as well as how to maximize their profit through demand insights.

Similarly, with better demand data flowing into the distribution, logistics and production pillars, companies can better manage over or underproduction and reduce waste, while also improving the utilization of their own assets (equipment, labor, utilities, storage, etc.).

Digitalization is the key enabler for new business model innovation across food and agriculture. For farmers and ranchers, it creates the foundation to access new markets, to differentiate their products based on quality and sustainability, to employ new B2B or B2B2C models.

With expanded supply chain digitization, retailers, consumer packaged goods companies, and foodservice companies will increasingly be able to leverage real-time demand data. This will help drive real-time planning and visibility, optimized inventory replenishment and ordering, agile omnichannel execution, reduced waste, and better customer experiences. At the same time, digital supply networks, which connect the physical and digital worlds via online trade, supply, and logistics platforms, will unlock the potential of vast datasets from physical assets and facilities in real time.

For buyers, processors, distributors, and logistics participants, these platforms will help to understand and overcome supply chain disruptions via larger trading networks, real-time visibility, and integrated demand planning.

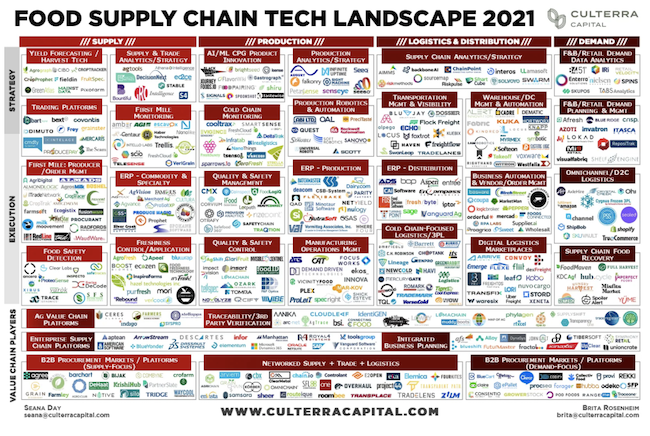

In this 2021 food supply chain tech landscape map you can find all relevant startups divided into the different categories comprising the supply chain and divided in subcategories.

.png.transform/rendition-xs/image_image%20(1).png)