Source: GFI APAC

Spanish alternative protein companies saw investment figures rocket by 5,527% in 2021, raising 26 million euros, up from just 0,49 million euros in 2020.

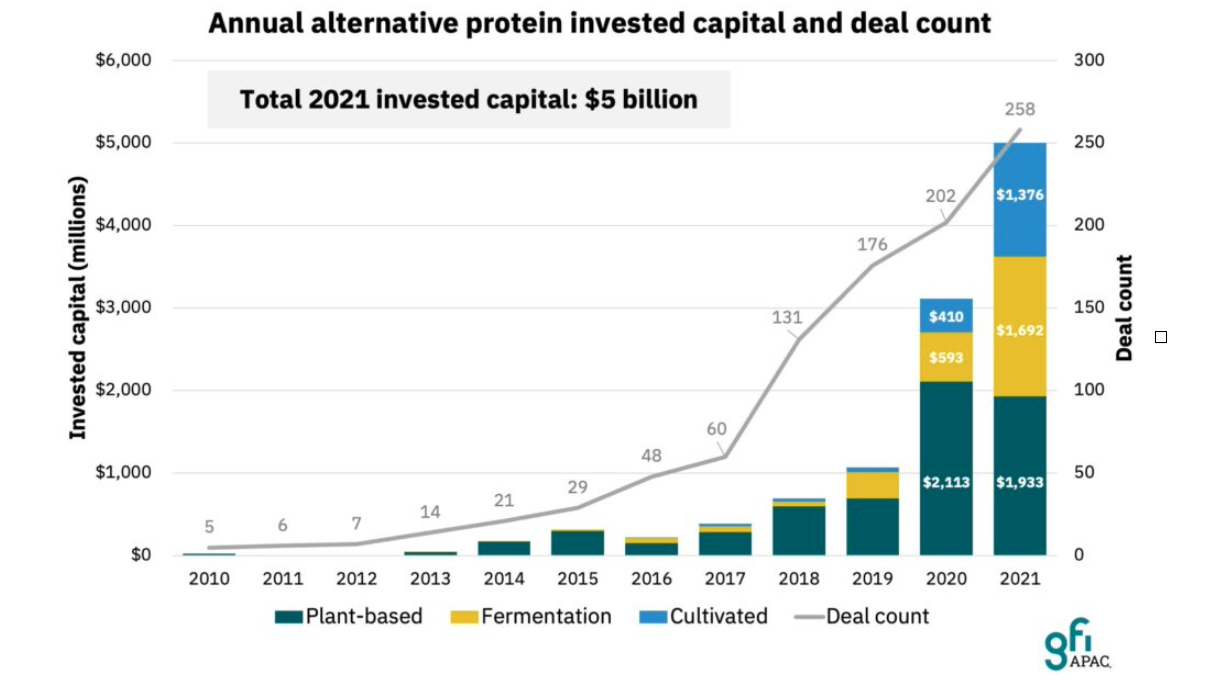

The rapid growth of the Spanish plant-based market are attributed to the actions and innovations of new players in the ecosystem, including big companies, technology centers, and disruptive startups. Aside from plant-based solutions, technologies such as fermentation, bioprinting, and cell cultivation are captivating investors' attention more and more, having a huge potential for innovation, and carving out a much larger slice of investment than ever before.

The investment in plant-based protein in 2021 accounts for only 39 percent of the total, with cultivated meat and fermentation close behind at 28 and 34 percent, respectively.

The advantage of these technologies is that they can be used to produce a wide range of foods, from meat and fish to dairy and egg alternatives. Every day, we watch startups lead the revolution in this space, creating new products and innovative ways to develop sustainable food products in every food sector.

Plant-based products are also receiving more attention in food events such as Alimentaria and HIP, as shown by the high number of stands where companies such as Flax and Kale, Zyrcular Foods, Future Farm, Heura, Sanygran, Dacsa Foods, among others are taking the lead by attracting more and more investors and sales.

Meat Alternatives

Despite accounting for only 3% of Spain’s €28 billion traditional meat industry (the fourth largest manufacturing sector in the country), meat alternatives are the fastest-growing category.

The use of fermentation and cell-based technologies is on the rise and expanding in Spain, as it is worldwide. An example of a Spanish company in the cell-based sector is BioTech Foods which is leading a €5.2 million cultured meat project funded by the Spanish government, investigating meat produced from cellular agriculture.

Fermentation is also likely to be one of the widely adopted technologies by several Spanish companies for creating animal-based proteins, as it can be applied to both precision fermentation and mycoprotein production. For example the Argentinean startup Innomy, which relocated to Spain in collaboration with the technological center CNTA, is using fungal tissue cultures and precise fermentation technology to build complex structures that mimic the fibrous and tender consistency of meat. Libre Foods and ODS Protein are two Spanish startups exploring the potential of this nutritious and sustainable form of producing meat alternatives from fungi with precision fermentation.

Additionally to the technologies already mentioned, a new advancement in Spain has been the development of bioprinting on a technological level. Although being in various development stages, two of the most relevant startups in the use of this technology are: Cocuus and Novameat. Cocuus has developed a technology platform whose objective is to create food production solutions by the application of bioprinting, with a broad application in alternative proteins. On the other side, Novameat, a startup emerged from research at the Polytechnic University of Catalonia, transfers biomedicinal knowledge to the production of filets by bioprinting.

Recently, the plant-based specialist Heura closed its second crowdfunding campaign 'Equity for Good Rebels', doubling the number of investors compared to its first campaign and raising a total of €5.42 million.The application of these technologies plays an important role in the future of meat production as they are meant to revolutionize the meat value chain as we currently know it.

Dairy Alternatives

Technological advances in the field of cell cultures and fermentation techniques are generating a disruption in the agri-food system. Unlike conventional production methods which require the whole animal to obtain the desired product (e.g. milk), they allow for food to be produced in a laboratory from each of its parts (protein, fat, carbohydrates, etc.), and maintain the quality of mimicry at a nutritional and sensory level to help replace traditional dairy products. Using this type of technology, food production will no longer be dictated by climate, seasons or geography, shifting from a centralized system dependent on scarce resources to a decentralized system based on abundant resources.

There is no doubt that food production through cellular agriculture and fermentation has a lot of potential in the food industry. These technologies, in addition to meeting the growing demand for nutrition, does so with reduced environmental impact.

Spanish startups as well as large dairy companies are increasingly innovating in this field in order to maintain their leadership. In this matter, Pascual Innoventures, part of the Spanish dairy company Pascual, along with other partners like Eatable Adventures and CNTA, launched Mylkcubator, the first global incubation program for cellular agriculture and fermentation technologies projects in the dairy industry. Among the projects featured were Real Deal Milk, De Novo Dairy, Zero Cow Factory and Pure Mammary Factors, all of which utilizes fermentation and cell based technologies to create their innovative alt. dairy products. These startups recently had the opportunity to showcase their projects and pave their way for future funding rounds that will enable them to pursue their innovative development and research. As a result of its success, they plan on launching a second edition of the program and support new startups worldwide to evolve and revolutionize the dairy industry.

Egg Alternatives

The global Egg Replacers Market size was assessed at 1.4 billion dollars in 2021, and is expected to grow at a CAGR of 6% until 2026. The sector is clearly booming, as vegan eggs were the fastest-growing segment in the plant-based market in 2020.

Despite the growing egg alternative market, it's still a relatively untapped market compared to meat-free burgers or plant milks. Even with the recent growth, egg substitutes are still not enough to meet demand in Europe, and innovative technologies are still to take place.

In the egg alternative sector there is a wide range of variety, beginning with the liquid-only substitutes, followed by the “whole-egg” replacement, or those mimicking hard boiled eggs. Furthermore, the ingredients list tend to vary from one to another. Many brands are working to reduce their ingredients list using mung beans, chickpeas, soy, among others. Nevertheless regarding the technological spectrum using cell agriculture and fermentation, their is still room for innovation to happen.

One example using fermentation as technology is Onego Bio, a finnish startup, which has developed a way to produce animal-free egg whites using precision fermentation process which enables cellular organisms to produce complex protein molecules, identical to the natural ones. Similarly, Every Company is leveraging precision fermentation technology to develop a versatile, all-purpose, 1-to-1 nature-equivalent egg white replacer with outstanding culinary functionality in North America.

Until now, there is no company leveraging this technology for egg replacement production in Spain. However, there are some Spanish companies in the market that cover this sector such as Vegg by Biográ, an egg replacement mainly made from chickpeas flour, as well as NaturGreen Veggs another egg replacement made from chickpleas flour and other species.

Also, many foreign companies are planning to sell their products in the country as the demand for these types of products are increasing. The famous JUST Egg will soon be available in Europe. The company has recently announced that its egg-like product based on mung bean protein has been approved by the European Commission for commercialization.

As much innovation is happening in the last few years, more is yet to come. The possibilities are endless when it comes to innovation in food, and more when it comes to new technologies with a wide range of applications in many fields as fermentation and cell agriculture are.

Seafood Alternatives

Alternative seafood is on the rise, with the potential to replace many popular foods, as well as offering enormous investment opportunities. According to the GFI Alternative Seafood Industry Update 2021 Report, seafood companies raised $175 million in 2021, nearly doubling the amount raised in 2020. Plant-based seafood has dominated the alternative seafood industry, with almost half of the new companies developing cultivated seafood. Lab-grown seafood startups accounted for 92% of the capital raised. In contrast, lab-grown meat accounted for 12% of capital raised in 2021 by alternative meat companies. Some highlights include, the largest sum raised in 2021 of BlueNalu’s $60 million of convertible debt, enabling to launch the world’s first commercial pilot facility for cultivated seafood. Furthermore, BlueNalu partnered with Nomad Foods, Europe’s leading frozen food company, to explore the introduction of cultivated seafood to the European market.

Recently, the seafood startup, Current Foods, founded by the Spanish - Sonia Hurtado, announced their partnership with Zyrcular Foods, with the objective of producing and distributing their plant-based salmon and tuna in Spain and eventually the rest of Europe.

Furthermore, the Spanish company Cocuus has used food inkjet technology and 3D printing to produce mimetic salmon, oysters and tuna.

Also, Mimic Seafood, a Madrid-based foodtech startup, is developing a new generation of plant-based seafood. Their first product is Tunato®, the first plant-based alternative to raw tuna made with tomatoes.

Since the seafood alternative sector is a relatively new market, new companies and technologies are still needed to disrupt the traditional seafood industry. In order to grow the industry and reach more consumers, more investment will be needed and production technologies will need to be improved.

.png.transform/rendition-xs/image_image%20(1).png)